Accounting has rightly been termed as the language of the business because of investment of financial resources in the form of material, man, and money are required. Accounting plays a very crucial role in managing finance of the business organizations. So today we have shared topics that covered the basics of accounting.

Accounting communicates the results of business operations to various parties that are directly or indirectly related to the business such as, the proprietor, creditors, investors, Government, and other agencies.

Although accounting is generally associated with the business, but it is present everywhere. And non-business persons like housewives, students, and any individuals also make use of accounting.

Basics of Accounting for beginners

You are also using a bit of accounting to manage your pocket money, you spent your money on purchasing products and services. And if you keep records of your all transactions on monthly basis then analyze your expenses. by this way, you can save a lot of money by just analyzing your transactions.

Accounting has so many benefits but to use it effectively you must learn the basics of accounting first and then the art of applying it in your business.

In this article, we have compiled all the topics that are the basics of accounting. The topics are as follows;

- What is Accounting? – Meaning and Definition

- Objectives of Accounting

- Nature & Scope of Accounting

- Process of Accounting

- Branches of Accounting

- Advantages of Accounting

- Disadvantages of Accounting

- Users of Accounting

- Important Accounting Terms

- Learn Accounting With an Example

If you are a fresher student and don’t know the meaning of accounting and finance terms. Then you have to start from the basics of accounting. then try to do questions practice to learn to accounts in the right manner. So let’s start our topic basics of accounting by answering the question what is accounting?

⦿ What is Accounting? – Meaning and Definition

Accounting was generally being treated as a record-keeping system till 1960. But in modern times, the accountant must not only accumulate, process, store and communicate financial information, but must understand the need of the users, the time when the information is needed and the form in which the information is to be supplied.

Accounting activity provides managers, taxpayers, directors, or whomever, with the financial information they need to make informed decisions.

Meaning of Accounting

The literal meaning of “Accounting” is - the process or work of keeping financial accounts.

- Accounting, as an information system is a process of identifying, measuring, and communicating the economic information of a business to its users who need the information for decision making.

- The systematic recording, reporting, and analysis of financial transactions of a business. The accountant is typically required to follow a set of rules and regulations, such as the GAAP – Generally Accepted Accounting Principles.

Accounting allows business organizations to analyze the financial performance of the business, and to get statistics such as net profit.

Definition of Accounting

American Institute of Certified Public Accountants (AICPA) defined accounting as

“Accounting is the art of recording, classifying and summarizing in a significant manner and in monetary terms, transaction, and events which are in the part at least of a financial character and interpreting the result thereof.”

In simple words,

“Financial Accounting can be defined as the recording, classifying, and summarizing transactions, events, and adjustments in a book of accounts.”

This basic definition of accounting relates to the operational part of the accounting function without having any reference to the objectives of keeping records and needs of users of the information for decision making.

⦿ Objectives of Accounting

The primary objectives and purpose of using accounting are as follows:

- To maintain accounting records.

- To calculate the results of operations.

- To ascertain the financial position.

- To communicate the financial information to the users.

- To Facilitate rational decision-making.

1. To maintain accounting records:

In general, Accounting is done to keep a systematic record of the following data.

- (i) financial transactions,

- (ii) assets and

- (iii) liabilities.

2. To calculate the results of operations:

Accounting helps in ascertaining the net profit earned or loss suffered on running the business. In accounting, the preparation of Income statements is there for the Profit & Loss Account.

3. To ascertain the financial position:

The businessman must know about his financial position such as where he stands? and what he owns? This objective is served by the Balance Sheet or Position Statement.

The Balance Sheet is a statement of assets and liabilities of the business on a particular date and generally, it is prepared annually.

It represents the financial health of the business.

4. To communicate the accounting information to the users:

Accounting is an information system for collecting and communicating economic information about the business enterprise to internal users (Participants at all levels of management) and external users (Banks, creditors).

5. To Facilitate rational decision making:

Accounting nowadays has taken upon itself the task of collection, analysis, and reporting of information at the required points of time to the management in order to facilitate decision-making.

➤ Importance of Accounting

- It keeps a systematic record of business,

- To avoid frauds and manipulations,

- To protect the properties of the business,

- To know the financial position of a business,

- It helps in decision making,

- Facilitates computation of tax,

- Provides Information to interested groups i.e. investors, customers

⦿ Nature and Scope of Accounting

The feature and nature of accounting can be understood from two points of view i.e. functional viewpoint and structural viewpoint.

Functional viewpoint –

- Accounting is related to the identification of transactions,

- Classification and measurement of transactions,

- Communication of accounting information.

Structural viewpoint –

- Accounting is an art and science,

- It deals with historical economic activity,

- Accounting is a process,

- Accounting is a language of a business.

- Accounting Process and Activities

➤ Scope of Accounting (Basics of Accounting)

Scope of Accounting is not limited to the business world alone but spread over in all areas of society and in all professions.

Economic activities and transactions occur all along in business organizations, government institutions, NGOs, and professionals. It also includes individuals and families. Accounting is all about keeping accounts of those financial transactions.

- Business Organisations

- Government Institutions

- Working Professionals i.e. accountants, doctors, advocates.

- Individual and Families

- Non-profit Organisations

- Tax Accounting

- Investors and Management

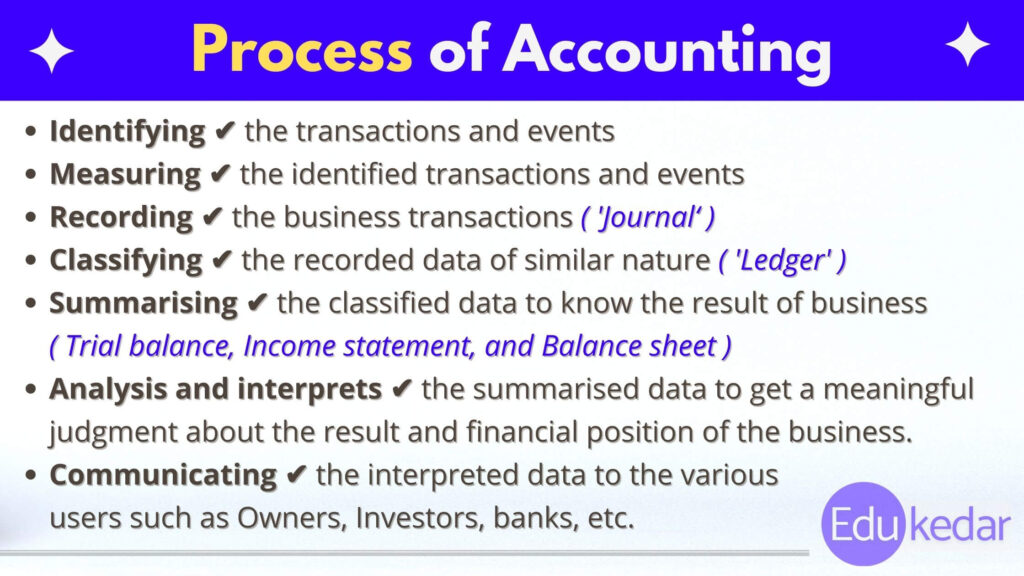

⦿ Process of Accounting

Accounting is known as the process of identifying, measuring, and communicating economic information to make judgments and decisions by users of the information.

First of all, the point to be noted here is “any economic transaction or event of a business which can be expressed in monetary terms should be recorded.”

The series of financial transactions of business occurs during the accounting period and its recording is referred to as an accounting process.

The activities under the accounting process are a complete sequence of accounting procedures that are repeated in the same order during each accounting period.

Traditionally, accounting is a method of collecting (identifying and measuring), recording, classifying, summarizing, presenting, and interpreting financial data of the economic activity of the business.

So let’s discuss all the steps involved in the accounting process.

- Identifying ✔ the transactions and events

- Measuring ✔ the identified transactions and events

- Recording ✔ the business transactions of financial character in the books (preparation of the first book called ‘Journal‘)

- Classifying ✔ the recorded data of similar nature in one place (preparation of the second book called ‘Ledger’)

- Summarising ✔ the classified data to know the result of business operation and its financial position (preparation of Trial balance, Income statement, and Balance sheet)

- Analysis and interprets ✔ the summarised data in such a way to get a meaningful judgment about the operational result and financial position of the business.

- Communicating ✔ the interpreted data to the various users such as Owners, Investors, banks, etc.

⦿ Branches/Types of Accounting

In order to satisfy the needs of different people interested in accounting information, the development of different branches of accounting serves the purposes.

Accounting can broadly be classified into three branches or categories.

- Financial Accounting

- Cost Accounting

- Management Accounting

1. Financial Accounting (Basics of Accounting):

It is the process of identifying, measuring, recording, classifying, summarising, analyzing, interpreting, and communicating financial transactions and events.

2. Cost Accounting:

Cost accounting refers to accounting and controlling the cost of a product, operation or function. The purpose of this branch of accounting is to ascertain the cost, control the cost, and communicate information for decision-making.

3. Management Accounting:

Management accounting is all about the application of accounting techniques for providing information designed to help all levels of management in planning and controlling the activities of business enterprise and in decision making.

The purpose of this branch of accounting is to supply any and all information that management may need in taking decisions and to evaluate the impact of its decisions and actions.

Always remember that when we say accounting in general, it is most likely about financial accounting. because cost accounting and management accounting cannot be done without financial accounting.

Now, let’s discuss the advantages and disadvantages of financial accounting.

⦿ Advantages of Accounting

Advantages or Benefits of accounting are as follows;

- Facilitates to replace the memory

- Facilitates to comply with legal requirements

- Facilitates to ascertain the net result of operations

- Facilitates to ascertain the financial position

- Facilitates the users to take decisions

- Facilitates a comparative study

- Assists the management in planning and controlling and decision making

- Facilitates control over assets

- Facilitates the settlement of tax liability

- Facilitates raising loans

⦿ Disadvantages of Accounting

Disadvantages or Limitations of Accounting are as follows;

- Ignores the qualitative elements

- Not free from Bias

- Estimated position and not a real position

- Ignores the price-level changes in the case of a financial statement prepared on historical costs

- The danger of window dressing

⦿ Users of Accounting

In every business domain, there are various groups of users of accounting information. Accounting information is used by investors, lenders, creditors, debtors, taxpayers, employees, Government regulatory agencies, and others.

Users of accounting information have their particular type of relationship and interest in a business entity. A few Users and their objectives of using accounting are as follows;

✦ Investors – Users of Accounting

• Information about growth – sales, volumes

• Profitability (profit margins, overall level of profit)

• Investment (amounts invested, assets owned)

• Business value (share price)

• Comparative information of competitors

✦ Lenders – Users of Accounting

• Cash flow

• Security of assets against which the lending may be secured

• Investment requirements in the business

✦ Creditors – Users of Accounting

• Cash flow

• Management of working capital

• Payment policy

✦ Debtors – Users of Accounting

• Sales growth

• New product development

• Investment in the business (e.g. production capacity)

✦ Employees – Users of Accounting

• Revenue and profit growth

• Levels of investment in the business

• Overall employment data (numbers employed, wage and salary costs)

• Status and valuation of company pension schemes/levels of company pension contributions

✦ Government – Users of Accounting

• Customs & Excise need accounting information to verify GST returns.

• Local government needs similar information to levy local taxes and rates.

✦ Business Analysts – Users of Accounting

They require very detailed financial and other information in order to analyze the competitive performance of a business and its sector.

⦿ Basics of Accounting – Important Terms

In accounting, there are specific terminologies of finance that are used in all activities such as recording, classifying, and analyzing transactions.

For beginners, it takes time to get used to these financial accounting terms. To make this process easy, we have addressed the most-used accounting terms here so any newbie can understand the meaning of these terms.

✦ Transactions: Economic activity in which a thing is exchanged for money or money worth.

✦ Capital: Money invested by owner or proprietor into business.

✦ Drawing: Money, or goods are withdrawn by the proprietor for personal use.

✦ Assets: Items that will bring cash in the present or in the future.

✦ Liabilities: Which will lead to an outflow of cash in the present or in the future.

✦ Revenue: Income or increase in net assets.

✦ Expense: Outflow of money in return for something.

✦ Loss: When we get nothing in return.

✦ Profit: The difference between the amount earned and the amount spent.

✦ Gain: Increase in wealth that is earned without effort.

✦ Voucher: A written document or proof of transaction.

✦ Debtors: To whom goods are sold on credits.

✦ Creditors: By whom goods are purchased on credits.

✦ Goods/Stock/Inventory/Merchandise: are things in which we deal.

✦ Trade Discount: given on the list price not accounted.

✦ Cash Discount: Calculated on cash payment to the vendor or received by the buyer and It will be accounted for.

✦ Personal Account: Related to persons or institutions.

✦ Real Account: Related to Assets and property.

✦ Nominal Account: Related to expenses, income, and gains.

✦ Journal: A book in which original entries of transactions are recorded.

✦ Ledger: A book of accounts where similar transactions relating to a particular person or thing are recorded from the journal entries.

✦ Trial Balance: Summary of the ledger and provides much of the information needed to prepare the Financial Statement (balance sheet and the income statement).

✦ Financial Statement: Income Statement and Balance Sheet are prepared in the financial statement. It is prepared to find out the net result and impact on asset, liability, and owners equity.

✦ Accounting Period: a period with reference to which accounts and financial statements are prepared. It can be monthly, quarterly, annually.

✦ Statement of Cash Flows: Summary of the course of changes in cash balance between the two dates of the balance sheets.

⦿ Learn basics of Accounting with an Example

Here we have given an example of Radhika Enterprises (a business firm) and how it operates. We have shared the anatomy structure of Business and its activities.

All the important accounting terms and their meaning are explained in this example so that the terms like Assets, Liabilities, Financial position, ..etc can be understood easily.

Suppose Radhika Enterprises, promoted by Ms.Radhika Agarwal as her proprietary firm, sets up a textile mill.

✱ How does Radhika start her business?

➤ First and foremost she will invest in

- Land

- Building

- Administrative building

- Plant and Machinery

- Vehicles

- Furniture and office equipment etc

➤ To earn a profit, Radhika contributes

- Partly Her own money

- Partly borrows a term loan repayable over five years from Delhi Financial Corporation

➤ Once the plant is constructed and commissioned, the firm needs further funds for its normal operating cycle, i.e.

- To purchase raw material

- Produce textiles

- Sell them to customers

- Realize cash and payback to the suppliers from whom credit is availed.

➤ In this process:

| the firm may not be able to sell its entire production | Inventory of finished goods |

| the production process may take a few days to convert raw material into finished goods | Work-in-progress inventory |

| The firm desires the production process is not held up for want of materials | Inventory of raw materials |

✱ How does Radhika arrange more funds?

It may have to pay the supplier immediately or in advance. Radhika Enterprise needs further funds to finance these activities.

Partly they come from RADHIKA and partly from STATE BANK OF INDIA in the form of bank overdraft or cash credit limits.

In the business, credit may also be available from suppliers as well as advances from customers can also be availed and to that extent, these sources also become a source of finance.

➤ Assets – Basics of Accounting

In the above example, there are resources like

- Land, building

- Plant and machinery

- Vehicles

- Furniture, office equipment

- Inventories of raw materials, work-in-progress and finished goods

- The amount receivable from customers (sold in credit) i.e. debtors

- Advances to suppliers of raw materials

- Cash

These resources are known as assets.

Assets are the resources controlled by a business enterprise that enable it to carry out its business operations for generating revenue.

✦ Type of Assets

In general, there are two types of assets in any business.

- Fixed Assets

- Current Assets

1. Fixed Assets:

Land and building, plant and machinery, vehicles, furniture, and office equipment are its Fixed Assets as they enable the firm to produce textiles.

- These assets provide a long-term economic benefit, usually spanning beyond one year, to the firm.

- They themselves are not held for sale.

2. Current Assets:

Inventories of raw materials, work-in-progress and finished goods, debtors, advances to suppliers of raw materials, and cash represent Current Assets.

- These assets are held for consumption (raw material and work-in-progress) or for sale (finished goods)

- Are expected to be realized in cash (debtors) or in-kind (advances to suppliers)

➤ Liabilities – Basics of Accounting

Sources of financing for Radhika Enterprises :

- Radhika’s contribution (owners’ capital)

- Term loan

- Bank borrowings for financing current assets

- The amount payable to suppliers from whom raw materials are purchased on credit (creditors)

- Advances from customers

These resources represent liabilities since they have to be paid back and settled through the delivery of textiles.

Liabilities are thus the obligations of the business enterprise that arise in the course of the business operations and are to be discharged/settled in the future.

✦ Types of Liabilities

In general, there are two types of liabilities in any business.

- Long term Liabilities

- Current Liabilities

- Contingent Liabilities

- Long-term Liabilities: In the above example term long for financing the fixed assets is repayable over five years. Any liability repayable over a period exceeding one year is termed as a long-term liability.

Radhika’s capital is also a long-term liability for the company.

- Current Liabilities: In the above example bank borrowings for financing current assets, creditors, and advances from customers represent current liabilities. Current liabilities are discharged within one year.

- Contingent Liabilities: In the above example, product warranties and potential lawsuits are contingent liabilities. It simply means the potential loss that may occur in the future depending on the outcome of a specific event. The contingent liabilities may or may not become payable in the future.

➤ Financial Statement

Though accounting is the process of identifying, measuring, and processing accounting information in the form of journalizing and ledger posting, but the main function of communicating information is being performed through the financial statements.

The medium used to communicate accounting information about a business enterprise is financial statements.

There are various components of financial statements i.e.

(i) Balance Sheet;

(ii) Income statement;

(iii) Statement of owners equity;

(iv) Cash flow statement; and

(v) The value-added statement.

Preparation of final accounts comprises Income statements and balance sheets only.

Financial Position: Assets and liabilities put together constitute the financial position of the enterprise. They are tabulated in the Balance Sheet.

More the excess of assets over the outside liabilities stronger is the financial position and vice versa.

ASSETS = LIABILITIES

A businessman must know about his financial position such as where his company stands? and what he owns?

A balance sheet helps in ascertaining the financial health of the business.

So here we have to conclude our article on the “basics of accounting” because further all topics are of an advanced level.

Advanced topics like Cash Flow statements, Financial Statement Analysis can only be understood by practicing the basic accounting process like journaling, ledger posting, trial balance, and preparation of final account or financial statement.

Basics of Accounting Notes – PDF Download Links

Introduction to Accounting (NCERT)

Financial Accounting Notes PDF (BBA)

Management Accounting Book/Notes PDF (MBA)